Automation of Payroll (Streamlining Your Payroll Process & Improving Accuracy)

Automation of Payroll (Streamlining Your Payroll Process & Improving Accuracy)

At month-end, payroll teams often face late timesheets, shifting tax rules, and last-minute errors before payday. Automation of payroll transforms this pressure into a structured process by integrating payroll software, time tracking, tax calculations, and compliance. The result is reduced errors, faster processing, and greater accuracy. It also helps cut approval delays, maintain direct deposits, and keep employee self-service systems running smoothly.

Cercli’s global HR system simplifies payroll automation by centralising HRIS, payroll processing, and compliance checks. This reduces time spent on routine tasks and allows greater focus on employees, reporting, and strategy.

What is Automation of Payroll?

Payroll automation utilises software and business rules to automate payroll tasks with minimal manual intervention. The system stores employee records, pay rates, tax codes, and benefits in a central database and applies them to each pay cycle.

Payroll software enforces company pay policies, statutory deductions, and pension contributions to calculate gross and net pay. This reduces repetitive spreadsheet tasks and minimises manual calculations.

Who Benefits and How Payroll is Delivered

Organisations gain faster pay runs, fewer errors, and a stronger audit trail. Digital payslips are generated automatically and made available via an employee self-service portal or by secure email.

Bank transfers or direct deposits are prepared by the payroll system and submitted to the bank or a payroll bureau for processing. Each action aligns with the payroll calendar and batch processing controls.

How Payroll Automation Works: Step-by-Step Process

Data Capture And Master Records

Employee master is entered once, like:

- Personal details

- Contract hours

- Salary

- Tax code

- Benefits

Time and attendance feeds, HRIS updates, and new starter or leaver forms are then updated automatically where systems are integrated. Accurate master data reduces exceptions during pay runs.

Integrations And Data Flows

Payroll systems link with:

- Time clocks

- Absence management tools

- HR systems

- Accounting software

These integrations import hours, overtime, bonuses, and expenses directly into the pay run, reducing manual entry and keeping the payroll engine supplied with accurate inputs.

Automated Calculations And Business Rules

Based on configured rules, the payroll engine applies:

- Tax tables

- National Insurance

- Statutory leave pay

- Pension contributions

It calculates gross pay, net pay, statutory deductions, and employer costs in real time.

Business rules can also cover:

- Variable pay

- Recurring allowances

- Salary sacrifice schemes

- Tax adjustments

Handling Exceptions And Adjustments

When a timesheet error, penalty, or manual adjustment arises, the system flags the exception and logs the change. Payroll administrators review, correct, and approve amendments before finalising the pay run. Each correction is recorded for reconciliation and compliance.

Payment Processing And Bank Submission

Once pay runs are authorised, the system generates payment files for the bank, including Bacs payment instructions and payroll journals for the ledger. Reconciliation tools then match payroll payments to bank statements, highlighting any discrepancies for investigation.

Payslips, Reporting, And Compliance

Payslips are issued automatically and made available to staff through a secure portal.

The system produces reports for:

- Tax filing

- Year-end submissions

- Payroll audits

- Management analysis

Built-in reporting features ensure statutory requirements are met and a clear audit trail is maintained.

Security, Access Control, And Audit Trail

Access is limited through role-based permissions, two-factor authentication, and encrypted data storage. Every pay run and every change is logged, creating an audit trail for compliance and regulatory review.

Employee Self-Service And Communication

Employees can access payslips, tax codes, and leave balances via a self-service portal. This reduces common HR queries and provides staff with direct access to their pay history and documents.

Reconciliation, Audits, And Continuous Checks

Automated reconciliation routines compare payroll totals with ledger entries and bank records. Discrepancies are flagged for resolution before audits.

Analytics And Forecasting

Payroll data feeds into workforce cost reports, labour cost forecasts, and headcount analysis.

This enables managers to model the cost impact of:

- Salary changes

- Overtime patterns

- Benefits decisions

Frequently Asked Questions

How Do Timesheets Tie Into Pay Runs?

Time and attendance data is imported directly into the payroll engine and mapped to pay codes for automatic calculation.

How Is Pension Auto-Enrolment Managed?

The payroll system applies employer and employee pension rules, calculates contributions, and generates reports for pension providers.

Moving from Spreadsheets to Automated Payroll

To validate calculations, key steps include:

- Ensuring master data accuracy

- Identifying integration points

- Defining authorisation workflows

- Preparing bank submission formats

- Running a test pay run

Related Reading

- Why Outsource Payroll Processing Services

- Employee Payroll Management

- What Is Payroll Management in HR

- What Is the Payroll Tax Rate

- How Much Does Payroll Processing Cost

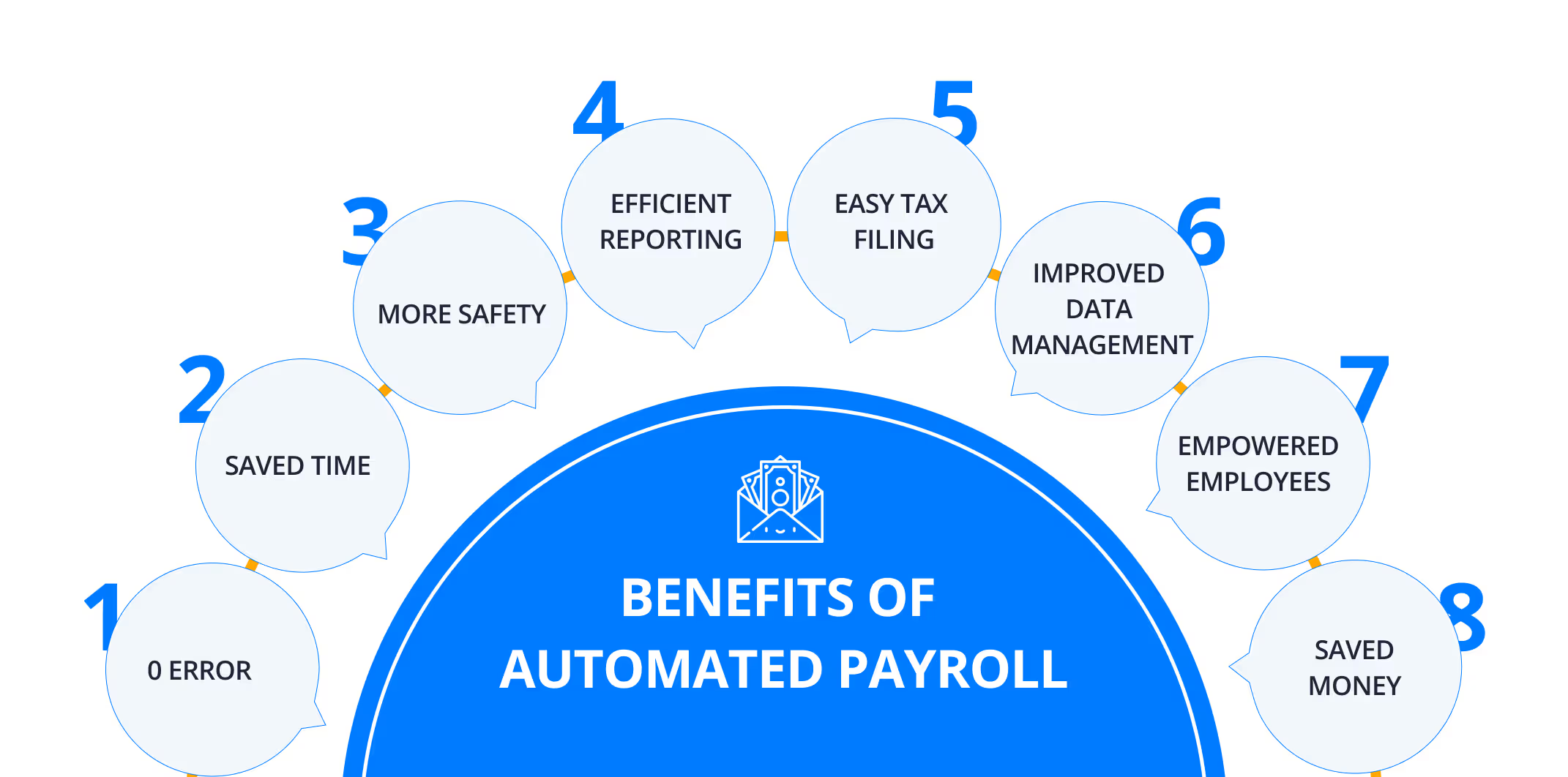

Key Benefits of Automating Payroll

Accuracy That Keeps People Paid

Manual payroll creates many opportunities for error when staff must re-enter the same data across systems. Each entry increases the risk of miscalculating overtime, tax withholding, or benefits, with mistakes compounding as calculations build on previous results.

For example, an incorrect overtime entry can alter tax withholding and net pay, often triggering time-consuming correction cycles. One study found that 24% of employees would consider leaving their job after just one payroll mistake.

Speed And Flow: Making Payroll Work Faster

Automating payroll streamlines routine tasks so HR and finance teams spend less time on:

- Calculations

- Data entry

- Chasing approvals

Work progresses more quickly because systems handle calculations, validations, and handoffs automatically, while integrations share accurate data with:

- Accounting

- Benefits providers

- Executives in real-time

This frees up teams to focus on strategic projects and employee experience.

Cut Costs Without Cutting Corners

Automation reduces labour hours and lowers the expense of correcting errors or late payments. Automated tax updates and compliance checks help avoid fines and ensure timely submissions, while digital payslips and batch transfers reduce printing and banking fees.

The system can also identify cost drivers, such as repeated overtime, enabling managers to address overspending.

Compliance Made Systematic

- Tax rules

- Employment law

- Contracts

- Union agreements

Automated systems apply:

- Jurisdiction-specific rates

- Update automatically when rules change

- Produce reports for regulators

They also help organisations meet record-keeping requirements, often spanning three to seven years, and make it far quicker to assemble records during audits.

Giving Teams Autonomy And Clear Roles

A centralised payroll system enables HR, payroll, and finance teams to work concurrently rather than sequentially, removing bottlenecks and delays. Role-based access controls prevent unauthorised changes, while shared dashboards increase transparency and allow issues to be identified and resolved early.

This enables teams to redirect time towards higher-value activities.

Locking Down Payroll Data

Strong payroll software protects data both at rest and in transit with encryption, and applies two-factor authentication and role-based access controls to restrict who can view or amend records.

Audit trails capture every action, while automated backups shorten recovery times after a system issue or breach. These safeguards make investigations easier and demonstrate compliance.

Scaling Payroll As You Grow

Automated payroll adapts to larger headcounts, varied pay schedules, and more complex classifications without a proportional increase in payroll staff. Cloud-based solutions offer on-demand capacity, enabling expansion into new regions or accommodating seasonal peaks.

They can also manage multiple tax jurisdictions and currencies, simplifying cross-border growth.

A Foundation For Wider Digital Change

Payroll automation often serves as a springboard for broader process automation, using tools such as robotic process automation and analytics to reduce manual work in HR and finance.

Once payroll becomes a reliable data source, organisations can integrate time tracking, leave management, and onboarding into a single flow, encouraging teams to adopt more efficient ways of working.

Cercli For Regional Payroll And HR In The Middle East

Cercli provides payroll and HR services for organisations operating in the Middle East. It supports Wages Protection System (WPS) registrations in the UAE, General Organisation for Social Insurance (GOSI) contributions in Saudi Arabia, and DEWS (DIFC Employee Workplace Savings) contributions, where applicable, and assists with the preparation of compliant employment contracts.

Cercli also supports multi-currency payroll and employer-of-record (EOR) services in more than 150 countries. The platform centralises onboarding, leave management, employee asset management, and payroll, reducing manual work and helping organisations process payroll accurately and on time.

Key Features of Payroll Automation Tools

Employee Data Management: A Single Source for Employee Records

Capture and store names, addresses, bank details, pension enrolment data, and salary information in a structured payroll system. Provide controlled access to employee records and record changes with an audit trail so you can track who edited what and when.

Link timesheet entries or new starter forms to payroll fields to remove manual re-entry and prevent data duplication. How can you keep sensitive payroll data secure while still allowing managers to see what they need and auditors to access information quickly?

Payroll Calculations: Accurate Gross-to-Net Processing

Automate calculations for wages, overtime, bonuses, and statutory pay, applying the relevant tax deductions, insurance, or social security contributions required in each jurisdiction. A rules-driven engine applies tax bands, thresholds, and pension contributions, ensuring that gross-to-net calculations are consistent across pay runs.

This reduces errors in tax, deductions, and repayment handling, and makes payroll processing faster for each pay period.

Built-in Compliance: Keep Pace with Regulatory Change

An automated payroll system updates tax tables and statutory rates and supports the tasks required at the end of the tax year. It generates audit logs and reporting formats that facilitate regulatory checks and meet the requirements of tax authorities.

The system also supports common compliance points, such as pension auto-enrolment administration and record-keeping for audits and RTI submissions in the UK.

Payroll Journal Reporting: Match Your Accounting Workflow

Customise payroll journals to map payroll data to your chart of accounts and export in layouts your accounting team already uses. Automatically send payroll journal entries to accounting software or generate CSV and API-based exports for reconciliation with ledgers.

This preserves familiar reporting formats and reduces manual posting, thereby speeding up the month-end close and payroll reconciliation process.

Automated Payments to Employees: Accurate Pay Runs and Scheduled Tax Payments

Automate employee payments so salary, wages, and statutory payments reach team members on payday through bank transfer or bulk payment files. Schedule tax authority payments to smooth cash flow and avoid missed deadlines.

Batch processing, payment approval workflows, and bank file export reduce the manual steps between payroll calculation and bank settlement.

Integrations: Connect Payroll with HR and Finance Systems

Integrate payroll with HR systems, time and attendance, and accounting platforms to create a single source of truth. Use APIs or file feeds to synchronise starters, leavers, and changes to pay, preventing duplicate entry and speeding up onboarding.

Integrations make payroll an integral part of the wider business workflow and enhance data integrity across systems.

Payroll Reporting: Reports for People, Finance, and Compliance

Generate:

- Payslips

- Pay history

- Cost centre breakdowns

- Variance reports

- Compliance reports on demand

Utilise payroll analytics to track labour cost trends, overtime, and headcount expenses, or create customised reports for auditors and pension providers. Which reports does your team need most, and how will regular reporting improve payroll accuracy and control?

Steps to Implement Payroll Automation

.avif)

Spot The Bottlenecks: Assess Current Needs

Start by mapping your existing payroll process step by step. Who collects timesheets, who approves overtime, how long does a payroll cycle take, and where do errors crop up? List recurring mistakes, late tax filings, and any manual calculations that add time or increase risk.

Use that list to set clear goals, such as:

- Reducing payroll errors

- Shortening cycle time

- Improving compliance

Choose The Right System: Select Appropriate Payroll Software

Match software features to your needs:

- Payroll processing

- Tax and social security calculations

- Multicurrency payments

- HRIS and accounting integration

- Reporting

Ask how the vendor handles:

- Payroll rules

- Payslips

- Direct deposit

- Contractor payments

How many employees will you manage, and does the product scale without additional customisation?

Move Clean Data Only: Migrate Payroll Records

Audit employee records, pay rates, benefits, historical payroll runs, and tax IDs before migration. Remove duplicates, correct bank details, and delete records of former employees who are no longer needed.

Test a small batch transfer, reconcile the totals, and maintain an audit trail to trace any discrepancies.

Set It Up To Match Your Rules: Configure And Customise

Define payroll frequencies, tax withholdings, overtime rules, and benefit deductions in the system.

Configure:

- Leave policies

- Timesheet checks

- Payroll approval workflows

Use a rules engine whenever possible to ensure calculations occur consistently and automatically.

Train People, Not Just Systems: Educate The Team

Run focused training for payroll staff, HR partners, and managers who approve time. Use real scenarios from your business so staff can practise handling exceptions and audits. Offer quick reference guides and short refresher sessions as the team becomes familiar with the system.

Test Without Risk: Run Parallel Systems

Run the automated payroll alongside your current process for several pay cycles to compare results. Reconcile wages, taxes, and totals line by line and fix any mapping issues. Keep both runs until confidence grows and discrepancies fall to an acceptable level.

Tune For Better Runs: Regularly Review And Optimise

Schedule regular reviews of:

- Payroll accuracy

- Processing time

- User feedback

Track metrics such as:

- Payroll errors per run

- Time spent on approvals

- Late filings

Utilise findings to streamline workflows, refine rules, or enhance integrations with time and attendance or accounting systems.

Lock Down Sensitive Information: Ensure Data Security

Apply role-based access controls and the principle of least privilege for payroll data. Require strong authentication, encrypt data at rest and in transit, and keep regular backups. Maintain an incident response plan and audit logs to respond quickly in the event of a breach or error.

Protect Compliance Across Borders: Payroll Compliance And Local Rules

Document local payroll obligations such as the Wages Protection System (WPS) in the UAE, GOSI in Saudi Arabia, and DEWS contributions where applicable. Ensure the system can generate the required reports and files for local authorities and support statutory year-end tasks.

For international teams, verify:

- Tax withholding

- Social contributions

- Compliant contractor contracts

Plan For Continuous Improvement: Evolve With Needs And Technology

Monitor:

- Software updates

- New payroll features

- Shifting regulations

Regularly reassess integrations with HRIS, time-tracking, and accounting systems to minimise manual work. Ask users what slows them down and prioritise small changes that reduce errors and speed up the payroll cycle.

Cercli: A Centralised Approach to Payroll and HR Management

If you need a single platform to manage regional and international payroll, consider Cercli as your global HR solution. It supports WPS registrations in the UAE, processes GOSI in Saudi Arabia, handles DEWS contributions, and manages multicurrency payroll in over 150 countries.

Cercli provides HR teams with a centralised system for onboarding, payroll processing, leave tracking, Employer of Record (EOR) services, and compliant contracts. This helps reduce manual processes and ensures payroll is managed with confidence.

Related Reading

- How Does Payroll Processing Work

- AI in Payroll Processing

- Benefits of Payroll Outsourcing

- Payroll Automation Benefits

- Payroll Tax vs Income Tax

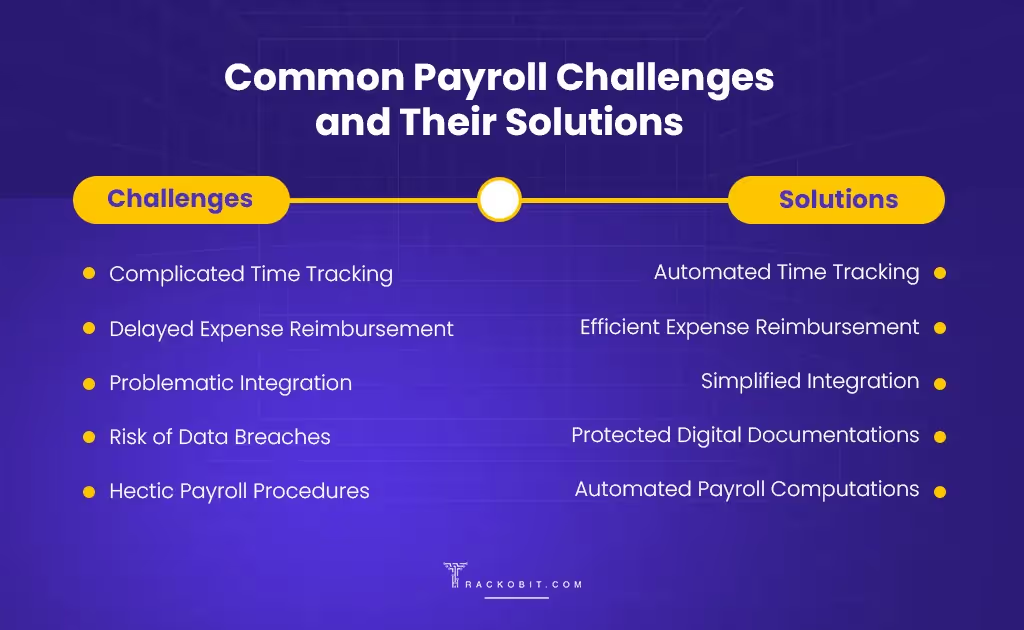

Common Challenges and Solutions

Addressing Employee Concerns About Payroll Automation

A common barrier is anxiety. SHRM’s 2023 Workplace Automation Research found that 23% of US workers worry automation will replace their jobs within five years. The American Psychological Association notes that employees who fear automation are 57% more likely to experience a decline in productivity and 78% more likely to feel undervalued.

How will your people react when pay runs move from manual spreadsheets to automated payroll processing?

Building Trust Through Transparent Communication

Start with clear, repeated communication. Explain that payroll automation focuses on accuracy, error reduction and faster payslips, while freeing HR teams to work on people-centred tasks.

Involve staff early:

- Invite representatives to review the payroll calendar

- Show how payroll reporting and payslip delivery work

- Run short demos of employee self-service functions

Offer practical training sessions and quick reference guides so people can see how net pay calculations, statutory deductions and gross-to-net reconciliation will be handled.

Practical Steps for Effective Change Management

Make change management practical. Assign owners for questions about payroll accuracy, data privacy and audit trails. Collect feedback after the first few pay runs and take action accordingly. What step will you take this month to ensure your staff feel heard?

Payroll Across Multiple Jurisdictions: Stay Compliant And Reduce Risk

Managing payroll for teams in different countries brings:

- Varying tax codes

- Labour rules

- Statutory deductions

- Reporting deadlines

Manual processes increase the chance of missed filings, incorrect tax calculations and late payments when rules differ by jurisdiction or when benefits administration varies.

Managing Payroll Compliance Across Jurisdictions

Choose automation or an outsourced payroll partner that updates tax tables automatically, supports multiple tax jurisdictions and produces jurisdiction-specific payroll reports. Ensure the solution handles local statutory deductions, pension and benefits contributions, and creates an auditable payroll reconciliation for each pay run.

Create a payroll calendar that takes into account local public holidays and pay frequencies, and map which payroll vendor or service covers each country. Have you documented all jurisdictions and their filing dates?

Maintaining Compliance Through Regular Reviews

Protect compliance with regular reviews.

Run:

- Automatic compliance checks

- Keep an archive of historical pay runs

- Schedule periodic audits of payroll reporting

Automating compliance tasks reduces administrative burden and limits costly errors as your organisation grows. In the UAE, for example, payroll systems must also comply with WPS requirements to ensure employees are paid on time and in a transparent manner.

Integrating Payroll With HR, Time-Tracking And Accounting

Poor integration creates duplicate records, mismatched time entries and transaction errors in the general ledger. When payroll data does not flow smoothly from the HR system to the payroll engine and into accounting, reconciliation becomes time-consuming and prone to errors.

Integrating Payroll Seamlessly with HR and Finance Systems

Prioritise solutions with robust API connectivity or pre-built connectors for your HR system, time tracking tools and accounting software. Create a single source of truth for employee records, so changes to pay rates, bank details, or tax status are updated across all systems.

Run a pilot programme that uses real-time tracking data and completes two full pay runs before going live. Which systems should be tested first in a controlled pilot?

Planning Technical Steps for Secure Payroll Operations

Plan the technical steps: map fields for pay items and deductions, set up secure data transfer with encryption, implement role-based access and keep an audit trail of changes. Provide technical support during cutover and schedule regular reconciliation processes for payroll reporting and bank files to catch anomalies early.

In regions such as Dubai and the wider UAE, this structured approach also demonstrates a commitment to transparency and employee protection.

Related Reading

- Payroll Management Software Features

- How Is Payroll Tax Calculated

- Employee Payroll Automation Software

- Best Payroll Software for Small Businesses

- How to Do Payroll for a Small Business

Book a Demonstration to Speak with Our Team about Our HR and Payroll Platform

Cercli helps companies in the Middle East manage HR and payroll through a central system. Run compliant payroll across the UAE, Saudi Arabia, and the wider MENA region, while also paying teams in more than 150 countries.

Manage leave, onboard employees, track assets, and handle global contractor payments in multi-currency accounts from a central dashboard.

This reduces reliance on:

- Spreadsheets

- Manual payroll runs

- Ad hoc cross-border payments

How Cercli Automates Payroll Processing

Cercli automates:

- Payroll runs

- Gross-to-net calculations

- Tax calculations

- Statutory contribution handling

The system applies:

- Payroll rules

- Incorporates local salary elements

- Produces payslips automatically

To spot exceptions before funds leave the account, it also provides:

- Payroll calendars

- Automated payment files for bank transfers

- Bank integrations

- Built-in payroll reconciliation

Audit logs record each run, allowing adjustments and approvals to be traced.

Compliance Controls for UAE, Saudi Arabia, and Regional Regulations

Cercli embeds local compliance checks for:

- Wage protection systems

- Social security

- End-of-service benefits

- Regional labour rules

The platform validates payroll data against statutory requirements and flags missing documents or incorrect contribution rates. Role-based controls allow in-country HR and finance teams to approve payroll changes, while compliance teams monitor exceptions.

Pay Contractors Worldwide in Multi-Currency Accounts

Pay contractors across more than 150 countries with multi-currency payroll and mass payouts. Cercli supports contractor onboarding, invoice validation, classification workflows, and local tax withholding where required.

Payment methods include bank transfers, payout networks, and integrations that manage foreign exchange and reconciliation across payroll runs and accounts.

Link HR Workflows to Payroll: Onboarding, Leave, and Asset Management

Employee onboarding feeds payroll with:

- Contract terms

- Pay components

- Benefit selections straight away

Time and attendance integration captures hours for hourly staff and contractors in automated payroll runs. Leave balances, salary changes, and company assets are tracked so payroll reflects real-time workforce data and ensures staff are paid the right amount on the right date.

Scale Payroll from 25 to More Than 500 Employees While Maintaining Efficiency

Cercli supports growth by applying uniform payroll workflows across markets while maintaining distinct local pay rules by country. Use templates for pay components, approval workflows for salary changes, and configurable pay cycles to support diverse teams.

Payroll analytics and dashboards highlight cost centres, overtime trends, and reconciliation gaps as headcount increases.

Data Security and Auditability in Payroll Operations

Cercli protects payroll data with:

- Encryption

- Role-based access

- Two-factor authentication

- Single sign-on options

Every payroll action leaves a complete audit trail for internal review and external audits. Secure bank integrations and tokenised payment files limit the exposure of sensitive bank details during payment processing.

Integrations and APIs to Connect Payroll with Your Tech Stack

Connect Cercli with accounting systems, ERP, banks, and HR tools through APIs and pre-built connectors.

Automate:

- Journal entry creation

- Tax filings were supported

- Reconciliation between payroll and ledgers

Triggers and approval workflows help close the gap between HR events and payroll runs so fewer exceptions require manual fixes.

Operational Benefits of Payroll Automation

Automation helps reduce payroll errors, shorten payroll cycle times, and minimise manual reconciliation effort.

Employee self-service lowers query volumes by giving staff access to:

- Payslips

- Tax documents

- Leave balances

Payroll reports and analytics support finance teams in forecasting cash flow and planning salary disbursements across multi-currency accounts.

Book a Demonstration

To explore how Cercli can support payroll and HR management in the UAE, the wider MENA region, and globally, you can book a demonstration with our team.